Taipei, Taiwan – China is facing a steeper climb to overtake the United States and its allies in semiconductors as Washington ramps up measures to restrict Beijing’s ability to produce advanced chips and secure dominance over the strategic technology.

Last week, Washington restricted the sale to China of select Nvidia and AMD advanced graphic processor units (GPUs) used in artificial intelligence applications and supercomputers.

The move followed the US Commerce Department’s announcement last month of a ban on exports to China of electronic design automation (EDA) software used in the production of next-generation chips.

Meanwhile, Washington has been nudging East Asian partners Taiwan, South Korea, and Japan to form a “Chip 4” industry alliance to isolate China from the international tech ecosystem, and bolstered efforts to develop its homegrown industry with the passage of the CHIPS Act, offering $52bn in subsidies to firms that make chips on US soil.

“The US is trying to reinforce its central role in the world’s semiconductor ecosystem and ensure that China is unable to produce the most cutting edge chips,” Chris Miller, author of the upcoming book Chip War: The Fight for the World’s Most Critical Technology, told Al Jazeera.

“Control over semiconductors will not only shape the future of the world economy, from cloud computing to autonomous driving, they are also fundamental to military power.”

Semiconductors have emerged as one of the fiercest battlegrounds in the intense rivalry between the US and China. Beyond functioning as the lifeblood of the modern economy, powering everything from iPhones to fighter jets, the chips are seen as critical to unlocking the technological breakthroughs of the future, meaning tomorrow’s global balance of power could rest on the wafer-thin chips being developed today.

China, like other major economies, relies heavily on semiconductor production in Taiwan, the source of more than 90 percent of the global supply of high-end chips, but has recently made considerable strides in developing its domestic industry.

In July, researchers at TechInsights reported that China’s national champion Semiconductor Manufacturing International Corporation (SMIC) had likely acquired the ability to produce a 7-nanometre (nm) chip, signalling a big leap forward after years of struggling to advance beyond a 14nm node. Semiconductors are typically compared by the length of their transistor gates, with a smaller gate generally corresponding with greater processing power.

Beijing-backed SMIC is now ramping up foundry capacity, with new plans for a fourth plant in the northern city Tianjin. SMIC did not respond to Al Jazeera’s request for comment.

“It’s a massive breakthrough,” Dylan Patel, an industry analyst and author of the newsletter SemiAnalysis, told Al Jazeera. “It’s missing some features, but it’s a fully functional node.”

“This is the first real sign they’ve broken through a supposedly insurmountable barrier. Now they need to incrementally improve the design and scale up the production to higher value chips.”

China has been blocked from acquiring the latest equipment for producing advanced chips — extreme ultraviolet (EUV) lithography machines — since leading Dutch manufacturer ASML was denied an export licence following US pressure on Amsterdam.

But Chinese firms can still use less efficient deep ultraviolet (DUV) lithography machines, which feature larger beam wavelengths typically used to etch patterns on less-advanced chips, to make high-end semiconductors.

Although Washington has flagged plans to expand its ban on chip-making equipment, China has been stocking up on ASML’s DUV lithography machines, buying up 81 machines last year alone.

“SMIC can fabricate a 7nm process with DUV, perhaps producing it en masse, but that does not make it cost-effective,” Ray Yang, a consulting director at Taiwan’s Industrial Technology Research Institute, told Al Jazeera.

“With DUV resolution, but you are pushing the technology to its limits,” Yang said, likening it to driving a consumer car at Formula 1 speeds.

[The beginning of the quote above seems like a sentence fragment unless the ‘but’ is a typo.]

“The yield rate is very low, therefore, it is not a cost-optimised solution for advanced processors and anything beyond 7nm is simply impossible.”

Yang said that SMIC could afford to use less profitable processes to produce advanced chips due to its state backing.

“Now that Huawei cannot use foreign foundries, China is heavily relying on SMIC for chips it urgently needs, likely for ‘special non-commercial uses,'” he said.

Those non-commercial uses include advanced weaponry for China’s growing military.

The links between Huawei, one of China’s biggest tech giants, and the Chinese military have been a longstanding concern for Washington, culminating in the Trump administration adding the company to the “Entity List” of sanctioned firms in 2019.

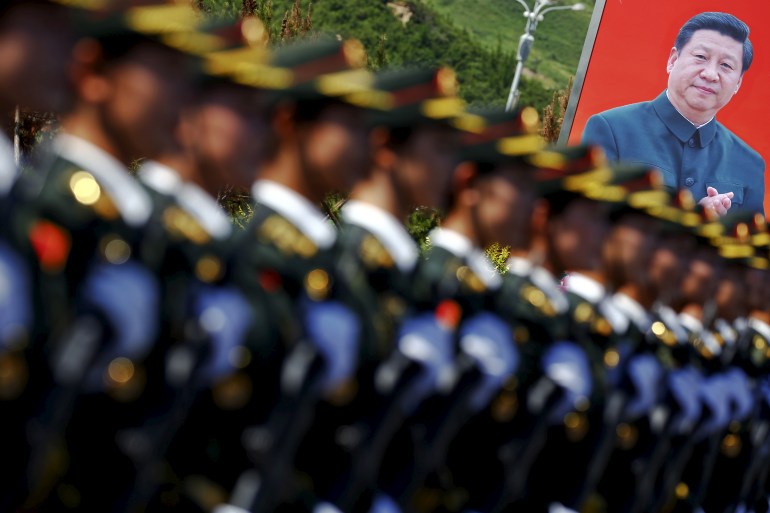

Under Chinese President Xi Jinping, leveraging private sector tech breakthroughs to bolster China’s defence sector has become a national priority, with its Military-Civil Fusion Strategy becoming a pillar of industrial policy.

“Chips are crucial for smart weapons. This is one of the reasons many policymakers are so concerned about the development of China’s semiconductor industry,” Douglas Fuller, an expert in technological development at the City University of Hong Kong, told Al Jazeera.

Although China is believed to still lack the technology to produce chips under 7nm, firms such as SMIC and Shanghai Micro Electronics Equipment Co are racing to develop their own indigenous machines to break the impasse.

“SMIC engineers have leaked complaints that those machines are prone to problems. China has not yet made a well-functioning ArF lithography machine,” Patel said, referring to a sub-type of DUV lithography machine.

“China is years behind in making chips with foreign tools, but decades behind with domestically-made tools.”

Chinese firms can also continue to design chips smaller than 7nm, even if they cannot necessarily produce them yet.

Last year, Alibaba unveiled one of China’s most advanced designs, the Yitian 710 — a 5nm server chip built for a range of internet-of-things (IoT) applications.

Even so, Washington’s latest restrictions are set to make the design phase for next-generation chips — those under 5nm — harder, too.

The next-gen chips are expected to rely on the emerging gate-all-around (GAA) design, which is widely considered a solution to the physical limitations of shrinking chips to infinitesimally smaller sizes.

“The ban impacts China’s pipeline today, but won’t hit their products and revenue for years to come since GAA will only be for 2nm nodes and under, which haven’t arrived yet,” said Patel, adding that 2nm nodes could make up half the output of the world’s leading chipmaker, Taiwan Semiconductor Manufacturing Company (TSMC), in the coming decades.

“It will be hard [for China] to sidestep these EDA suppliers,” Patel said. “However, Cadence [a leading American EDA supplier] has joint ventures in China, and offers its design programs at a discount in China compared to US customers. So China could have some leverage over the firm there and exert pressure on them.”

Yang said China would do all it could to procure necessary lithography equipment if it was prevented from purchasing it on the open market.

“This could entail reverse engineering, IP theft, or strategically acquiring foreign firms … which has happened many times in the past with other critical technologies,” he said.

China is also seeking breakthroughs by pouring resources into alternative materials to silicon, such as carbon. Beijing has included research on carbon fibre, graphene, silicon carbide, and other carbon-based composites in its 14th Five-Year Plan.

“It’s a potential tech of the future, but it has yet to be proven at scale,” Patel said. “You can make a super fast chip in a lab at crazy clock speeds, but making it on an economically feasible model is a whole other story.”

“If it does turn out to be a technology of the future, China is marginally closer to the forefront. The gap it needs to close is comparatively smaller.”

"chips" - Google News

September 09, 2022 at 11:17AM

https://ift.tt/Vjh8wdT

China’s great leap forward in chips faces US pushback - Al Jazeera English

"chips" - Google News

https://ift.tt/AIVBOUM

https://ift.tt/lJkAmxT

Bagikan Berita Ini

0 Response to "China’s great leap forward in chips faces US pushback - Al Jazeera English"

Post a Comment