Investors are piling into Chinese chip, software and biotech groups at a record pace while paring their bets on ecommerce, as they try to align with Beijing’s policy priorities and sidestep a broadening regulatory crackdown.

Chinese president Xi Jinping has led a regulatory assault on internet platforms this year, hitting those in food delivery, ecommerce, fintech, gaming and education.

But the Chinese Communist party’s desire to advance technologies such as high-end manufacturing has boosted other companies.

China’s semiconductor sector has been supported by a multibillion-dollar government plan, partly to counter US determination to stifle its technology industry. Beijing wants the country to make 70 per cent of its semiconductors domestically by 2025, up from a third today.

The value of venture capital investment into Chinese semiconductor companies increased 446 per cent in the second quarter compared with the first, to a record $8.9bn, according to data from Preqin. In one deal, Chinese manufacturing group BYD Semiconductor raised Rmb1.9bn ($293m) in a Series A round from investors including Sequoia China in May.

“For China, the most important areas of technology include semiconductors, aviation and life sciences. When President Xi talks about the importance of technology, he has expressly elevated the manufacturing industry over digital goods,” said Dan Wang, a Shanghai-based technology analyst at Gavekal Dragonomics.

Beijing has also encouraged investment in artificial intelligence. WeRide, an autonomous driving start-up, raised $310m from investors including the Renault-Nissan-Mitsubishi Alliance in June.

In contrast, investments in Chinese fintech companies fell 36 per cent to $360m in the second quarter compared with the previous one, according to Preqin. The sector has been subject to a crackdown since regulators pulled the $37bn initial public offering of Jack Ma’s Ant Group at the last minute in November.

Meanwhile, investments in gaming and ecommerce companies dropped 96 per cent and 54 per cent to $121m and $4bn, respectively, in the second quarter. Groups that operate in these spaces, such as Tencent and Meituan, have also been targeted by Chinese regulators this year.

The co-founder of one big Silicon Valley venture capital investor with a large China fund said it still planned to invest in the country but only in biotechnology, software and other sectors deemed as “safe”.

There were 74 fundraising deals in the chip space in the second quarter and 133 for software companies, according to Refinitiv, another data provider. By comparison, there were only 42 in the ecommerce sector.

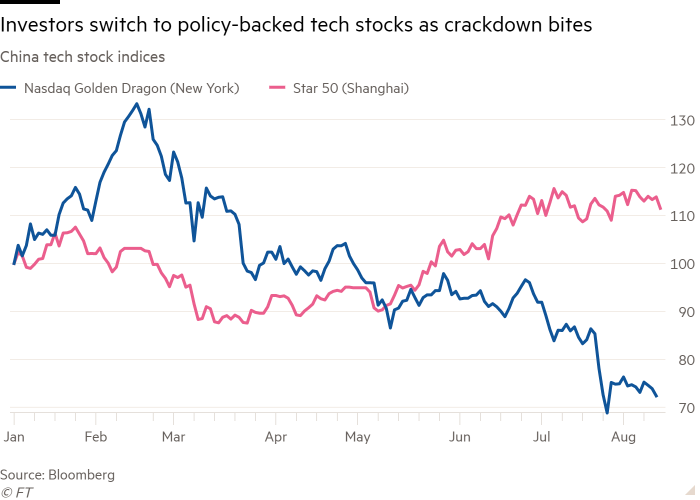

In public markets, Chinese internet companies have also been hit in recent weeks. The Nasdaq Golden Dragons index, which tracks big US-listed Chinese stocks including Alibaba and search group Baidu, is down 23 per cent since the start of July.

Investors have instead bought into shares of electric vehicle (EV) makers, renewable energy companies and other areas Beijing has designated as priorities to develop.

Shanghai’s Star 50 index, which tracks companies in such industries, is up 14 per cent in 2021.

Shares in EV makers BYD and Geely, as well as chipmakers such as Tianjin Zhonghuan Semiconductor, have surged this year.

“Investors . . . want to go into areas like electric vehicles and batteries as a safe haven,” said Louis Tse, managing director at Hong Kong brokerage Wealthy Securities. “Where else can the money go? It goes to stocks supported by national policy.”

"chips" - Google News

August 16, 2021 at 06:30AM

https://ift.tt/37JGGjI

Investors pivot from ecommerce to chips to avoid China crackdown - Financial Times

"chips" - Google News

https://ift.tt/2RGyUAH

https://ift.tt/3feFffJ

Bagikan Berita Ini

0 Response to "Investors pivot from ecommerce to chips to avoid China crackdown - Financial Times"

Post a Comment