porcorex

It’s hard to go wrong with a basket of blue chip stocks like Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL) over the long-term, and even over-priced Nvidia (NVDA) may be a good bet if one has a decade long horizon. The operative word is of course, long-term, and unfortunately, no one can guarantee a good price on any of those names should a financial need arise in the near or medium term.

Plus, while there can be plenty of wishful thinking for the long-term, the majority of people are usually more focused on the near-term, and having blue-chips that pay next to nothing for holding onto them just isn’t going to cut it when it comes to cash needs for life’s needs such as nice dinners, vacations, and unforeseen events such as a job loss.

That’s why a better strategy may be to include high-yielding blue chips stocks that pay you for holding onto them, while also giving capital appreciation potential. There is a saying in the brokerage industry that “investors sell yield last”, and for good reason, since it's income generating investments that can potentially pay for everyday living expenses.

This brings me to the following 2 picks, which generate a combined 9% average yield. Both have durable qualities about them that can give a solid income boost to any portfolio, so let’s get started.

Pick #1: Ares Capital

Ares Capital (ARCC) is best known for being the largest BDC on the market. Its externally-managed by Ares Management (ARES), a well-respected alternative asset manager with $360 billion in AUM and investment solutions that span across credit, private equity, real estate, and infrastructure assets, giving ARCC valuable industry expertise and deep line of sight into the credit landscape.

Due to ARCC’s size, it invests in the upper middle market, a segment that’s less cyclical due to the more established nature of these companies compared to the lower middle market. Since inception in 1997, ARCC has produced a 1% average annual net realized gain in excess of losses.

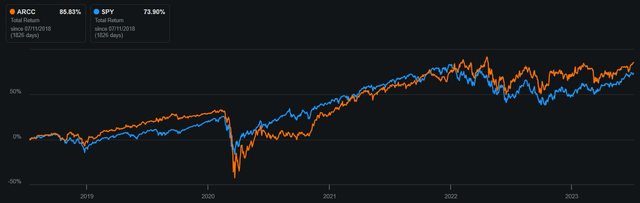

While that may not seem like much, it adds up over time and when combined with a high dividend yield, can produce outsized total returns. As shown below, ARCC’s total return has beaten that of the S&P 500 over the past 5 years with an 86% total return compared to the 74% of the latter.

Seeking Alpha

Meanwhile, ARCC carries a well-balanced portfolio of primarily senior secured loans, which represent 65% of its portfolio. It also acts as an external manager of Ivy Hill Asset Management, a private investment vehicle, which comprise 11% of ARCC’s assets.

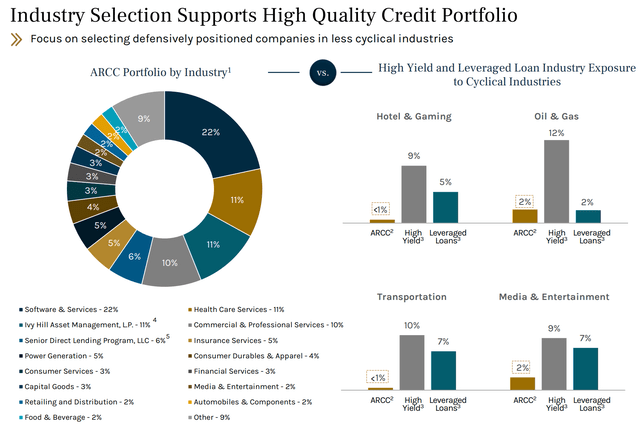

Unlike tech and life sciences focused BDCs like Hercules Capital (HTGC) and Trinity Capital (TRIN), ARCC adopts a more well-balanced approach, making it less susceptible to secular risk in any one industry. As shown below, top industries include less cyclical industries such as healthcare, commercial services, insurance services and power generation.

Investor Presentation

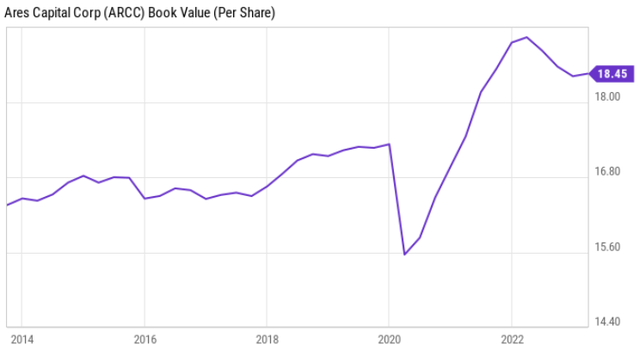

Meanwhile, ARCC has largely benefitted from higher interest rates due to most of its debt investments being floating rate, with core EPS rising by 36% YoY to $0.57 during the first quarter. This more than covered its $0.48 quarterly dividend at an 84% payout ratio. Plus, book value per share grew by $0.05 on a sequential QoQ basis to $18.45. As shown below, ARCC has done a good job of growing its book value over the past 10 years, with the recent decline due to widening credit spreads (due to higher interest rates) rather than any realized losses.

YCharts

Risks to ARCC include the potential for a recession, which may put pressure on its borrowers. Investments on nonaccrual rose to 2.3% from 1.7% at the end of 2022, and is something worth watching out for, but it remains comfortably below ARCC’s 15-year average of 3%.

Looking ahead, ARCC is well-positioned from a balance sheet standpoint, with a reasonably low debt to equity ratio of 1.09x, sitting far below the 2.0x statutory limit. This, combined with ample liquidity gives it plenty of firepower to fund its $500 million investment backlog as of early in the second quarter.

Lastly, ARCC trades at a good value point at the current price of $19.12, equating to a price to book value of 1.04x, sitting towards the low end of its trading range over the past 5 years, outside of the 2020 timeframe, as shown below. Considering all the above, I believe ARCC could reasonably trade at a price to book value of 1.1x, which could mean a potential total return in the high teens when factoring in the 10% dividend yield.

Seeking Alpha

Pick #2: British American Tobacco

British American Tobacco (BTI) hasn’t had an easy go over the past year, as high inflation has led consumers to down-trade to cheaper tobacco brands. Also uncertainty around a menthol ban continues to be an overhang for the company, considering that the Newport brand is one of RJ Reynolds’ (a BTI subsidiary) top selling brands in the U.S. All this has pushed BTI stock down to a $33.24 price with a forward PE below 8x.

Notwithstanding these headwinds, BTI remains a compelling story in its transition to reduced risk products. Since 2018, BTI has grown its non-combustible consumer base by 30% on a CAGR basis, reaching over 23 million. This includes 900,000 new customers that were added in the first 3 months of this year alone.

New category revenue has grown at an impressive CAGR of 33% over the past 4 years, and management is confident in their ability to achieve £5 billion revenue by 2025 regardless of its transfer of businesses in Russia and Belarus. Moreover, management has pushed up its guidance for profitability in the New Category segment by one year, from 2025 to 2024 during its recent first half trading update in June.

While Philip Morris International’s (PM) IQOS brand remains the top selling heat-not-burn product, there is room for more than one HnB product on the market. This is reflected by BTI’s glo product outpacing THP category growth, delivering in excess of 25% revenue growth last year. Although glo sales have slowed so far this year, the new Hyper Air platform was launched in 4 European markets this year, and could be a promising addition.

Plus, BTI’s management seems keenly aware that not all markets are as receptive to HnB as Japan, as it has the most broad-based nicotine portfolio in the industry. This includes the Vuse vaping and Velo nicotine pouch brands, which retain #1 or #2 positions in key European markets. Vuse is also the number one vaping brand in the U.S.

Risks in the near-term to BTI include a prolonged economic downturn, which would add pressure to consumers and depress demand for BTI’s traditional smokables. Plus, the suspension of buybacks also has not helped the share price. However, I view that as being the right move, as lowering debt levels is generally a good idea regardless of the interest rate environment. On that front, management targets returning to a safer net debt to EBITDA ratio in the mid 2-3x range by the end of this year.

A depressed share price is good for dividend investors seeking to layer in fresh capital, as BTI currently yields 8.5% (based on the stated quarterly dividend rate of USD $0.705, subject to currency fluctuations). BTI also has a lower payout ratio than both Altria (MO) and Philip Morris, with it sitting at 65%.

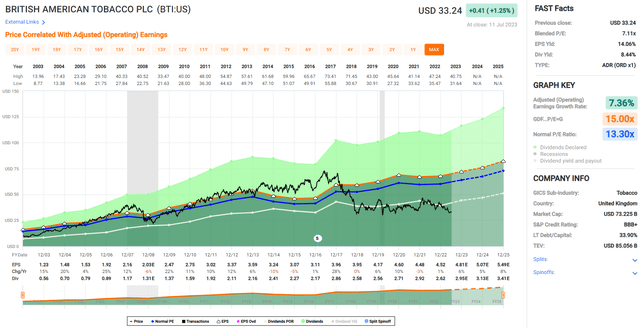

Lastly, it appears that headwinds are more than baked into the current share price of $33.24 with a blended PE of 7.1, sitting below its normal PE of 13.3. At this low of a valuation, BTI could deliver market-beating returns with its high dividend yield combined with a low-bar annual EPS growth rate in the low single-digits. I believe BTI is deserving of a forward PE in the 10-12x range, which in itself could result in potentially strong double digit returns.

FAST Graphs

Investor Takeaway

Overall, I believe ARCC and BTI are two interesting income plays that can deliver potentially strong total returns at their respective valuations. While there are risks associated with each company, they both have durable business models that should help them to withstand adversity.

Furthermore, both companies offer attractive dividend yields and low valuations (especially the case with BTI) which should help mitigate downside risk at a time when growth stocks are flying high on optimism. As such, value and income investors could be well served by taking a hard look at these two picks for high income and potentially strong long-term returns.

"chips" - Google News

July 13, 2023 at 02:54AM

https://ift.tt/PqKpOCg

2 Blue Chips To Buy And Hold, Averaging 9% Yield - Seeking Alpha

"chips" - Google News

https://ift.tt/8JGe9Ej

https://ift.tt/kJTvHDq

Bagikan Berita Ini

0 Response to "2 Blue Chips To Buy And Hold, Averaging 9% Yield - Seeking Alpha"

Post a Comment